US government so far this year spent more than same period of 2024 as GOP mulls spending cuts

The Congressional Budget Office reported that the U.S. government has spent $2.4 trillion from January through April 2025, which is $196 billion higher than the same timeframe from 2024,

Federal spending is higher in the first 7 months of this fiscal year compared to the same time period of 2024 as Republicans in Congress debate the level of spending reductions and tax cuts to include in their budget reconciliation bill.

After President Trump's election win in 2024, GOP congressional leaders had considered passing two separate bills using reconciliation but eventually decided on passing one mega-bill. Reconciliation is a tool that has been used by both parties to bypass the Senate filibuster. The budget bill now appears likely to pass by early July as congressional leaders continue to negotiate the details of the bill.

In addition to the overall level of spending cuts and amount of tax cuts, one of the sticking points in negotiations over the bill has been reforming Medicaid, which conservatives in Congress have been advocating to include in the budget reconciliation bill. Moderate Republicans have written to House Speaker Mike Johnson opposing Medicare changes.

As lawmakers continue to debate tax and spending policies, the latest data from the Congressional Budget Office (CBO) shows that the U.S. government spent $2.4 trillion from January through April 2025, which is $196 billion higher than the same timeframe from 2024.

CRFB: "Unsustainable fiscal outlook"

"Tax receipts in April pushed borrowing for the first four months of the year $5 billion lower than last year," the Committee for a Responsible Federal Budget (CRFB) said in a press release about the latest data.

The U.S. has borrowed a total of $1.1 trillion in the first seven months of the current fiscal year, according to the latest CBO data estimates.

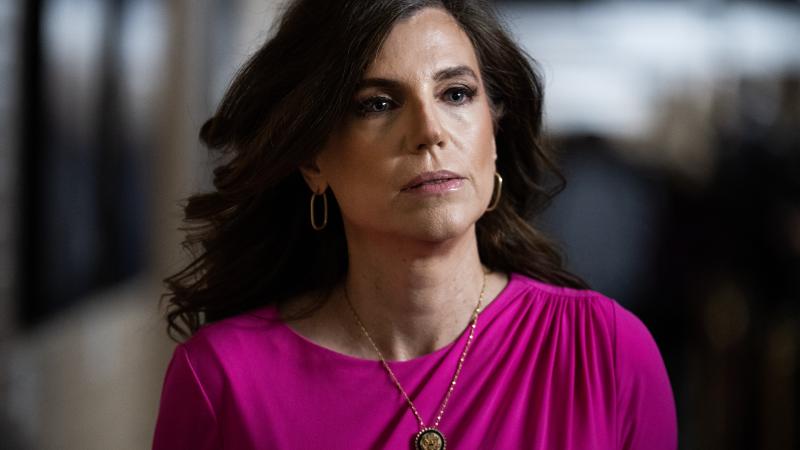

"Instead of continuing to add to our record high national debt with trillions in unpaid-for tax cuts and spending increases, lawmakers should come together to seriously address our unsustainable fiscal outlook," Maya MacGuineas, president of the Committee for a Responsible Federal Budget (CFRB) said in a statement. "Our fiscal outlook is on a destructive path, and it is about time we do something to fix it," she added.

Republicans have not been able to agree on the level of spending cuts that should ultimately be included in the reconciliation bill, which is still being crafted. Trump has said he wants a "big, beautiful bill" that includes both tax cuts and spending reductions. A debt limit increase would also need to be passed.

Some Republicans like Sen. John Cornyn, R-Texas, have suggested that the final reconciliation bill likely won't pass before July. The House and Senate have each passed their own framework for the legislation, but the final contents of the legislation are still being negotiated.

Accounting firm Ernst & Young published an analysis quoting Cornyn as saying: "The House is planning, for now at least, to send its legislation through congressional committees. The Senate has no current plans to do that; they'll assemble their own bill or tweak whatever the House sends over. That could lead to a leadership-negotiated Senate bill that amends the House's work and tees up a final deal. There could be a world in which the House passes their bill, and then, you know, we're here."

Different demands and very thin margins heighten uncertainty

"We can't fail because the debt ceiling is riding on this, which is really what's driving the timetable, so my prediction is we'll have this wrapped up by July," Cornyn said during a press gaggle this week on Capitol Hill.

"There's a lot of different demands and very thin margins, particularly in the House, with I think roughly 7 votes difference between the Democrats and Republicans, but then we have 53 Republicans here, and we can't afford to lose very many here. We'll be earning our paycheck in getting this done as we must," he added.

The CRFB has estimated that extending the 2017 Trump tax cuts and including new benefits Trump promised on the campaign trail in 2024 could drive the cost of the package from $5 trillion to as high as $11 trillion over 10 years.

The tax policies Trump had pitched on the campaign trail included eliminating taxes on tips, Social Security benefits and overtime pay, but House Speaker Mike Johnson might now be considering a thinner tax cut and spending package than initially anticipated.

The latest reports indicate that the tax reductions could come out to around $4 trillion in the House, while spending reductions could total $1.5 trillion. It is unclear which specific policy changes are on the table. House committees have started to hold markups on several parts of the reconciliation package, but the spending cuts have not been finalized.

"The Senate’s April 5 amendment adds reconciliation instructions for the Senate that require only $4 billion in gross deficit reductions and allow a $5.8 trillion net deficit increase, while the House instructions require $2 trillion in gross deficit reductions and allow a $2.8 trillion net deficit increase," the CRFB said this past Thursday.

"Now that the House and Senate have adopted the same budget resolution with reconciliation instructions, lawmakers are discussing what to include in a forthcoming reconciliation package," their analysis also said.