House legislation sunsets Trump's no tax on tips and overtime in 2028, his last year in office

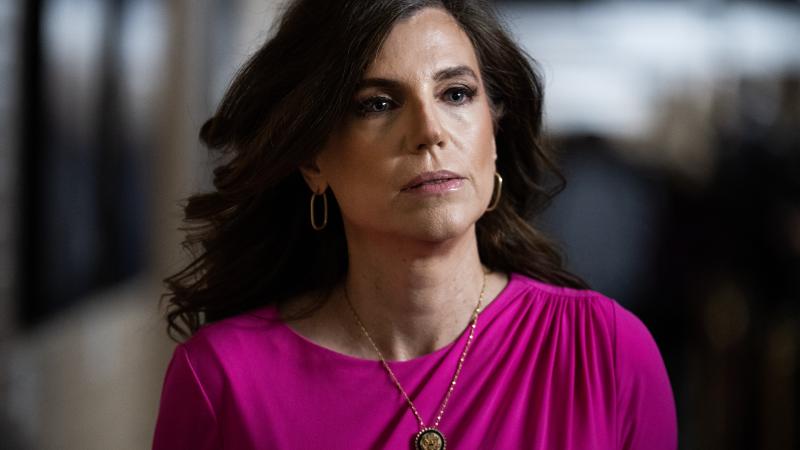

"It's ironic that we're leaving some of Biden stuff in perpetuity, but we're going to make Trump's agenda phase out. Very ironic," says Rep. Eric Burlison, R-Mo.

Some of the key tax benefits in President Trump's "big, beautiful bill," such as eliminating tax on tips and overtime pay, will expire in 2028, according to the text approved this week by the GOP-led House Ways and Means Committee.

The GOP-led House Budget Committee voted against the bill Friday, but it will be reconsidered for approval next week.

The current version of the bill allows eliminating tax on tips as well as overtime pay to sunset in 2028, leaving the fate of those benefits to be decided by a future Congress.

"It's ironic that we're leaving some of the Biden stuff in perpetuity, but we're going to make Trump's agenda phase out. Very ironic," Rep. Eric Burlison, R-Mo., said Friday on the John Solomon Reports podcast.

Eliminating tax on car loans by allowing taxpayers to deduct up to $10,000 of paid interest would expire in 2028 as well.

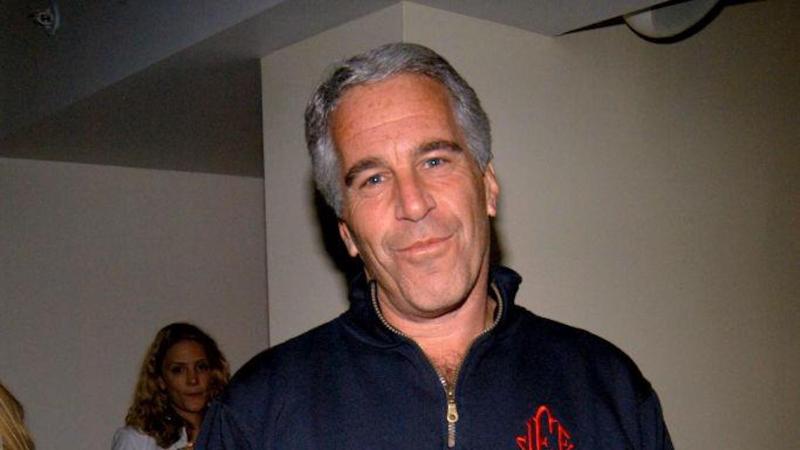

Each of these tax policy changes were part of President Trump's 2024 campaign platform.

Trump has said Social Security benefits shouldn't be taxed but that change didn't make it into the bill.

"Although the legislation would not eliminate taxes on Social Security benefits, it would boost the standard deduction for most Social Security beneficiaries," the Committee for a Responsible Federal Budget reported.

According to the CRFB, the current version of the bill will cost more than $3.8 trillion as written. If the temporary provisions wind up being extended for a 10-year period, the bill would cost about $5.3 trillion.

The CRFB noted that the Senate is likely to amend the final version that the House ultimately passes.