China in distress: Protests, economic signals reveal pressure from U.S. tariffs

In the "socialist market economy" of China, some cracks are visible that show a country unprepared to stand up to Trump tariffs long-term. China has been increasingly opaque in markets and manufacturing information.

As Beijing and Washington meet this weekend in Switzerand for trade talks, the Chinese economy is in more significant distress than is widely reported. The country is facing heightened pressure from an ongoing property crisis, protests, and a general economic downturn, in part because of recent U.S. tariffs.

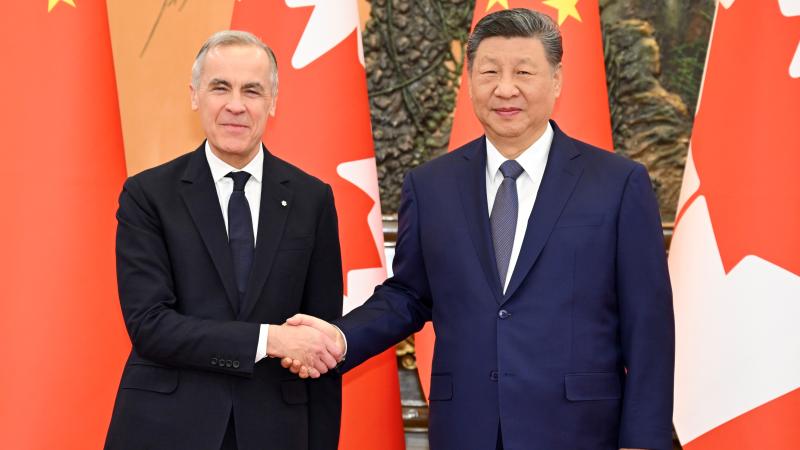

U.S. Treasury Secretary Scott Bessent is holding meetings with senior Chinese Communist Party Politburo member, Vice Premier He Lifeng, China's top economic official, in the Swiss capital of Geneva this weekend. The two are likely to discuss the ongoing trade war that erupted after President Donald Trump imposed sweeping 145% tariffs on China after a tit-for-tat exchange last month.

The Chinese Communist Party and its leader, Xi Jinping, have publicly expressed confidence in Beijing’s ability to weather the tariff storm and have urged the Chinese people to be unified in the face of the challenge to its economy.

Opacity in market information

However, in an era when Chinese economic data is being increasingly concealed by Xi’s regime, there are still significant publicly available warning signs that the Chinese model is under severe strain, the tariffs being only the latest amplifier.

“Their economy is actually in distress,” Gordan Chang, a lawyer and China commentator who lived and worked in Shanghai and Hong Kong for decades, told the Just the News, No Noise TV show on Tuesday. “They reported 5.4% growth for the first quarter, but when we look at underlying indicators, it looks more like zero. And we know the direction, which is down,” he said.

Though China has become increasingly secretive with its economic data, available price data for February and March “indicate the Chinese economy is in a deflationary spiral that's very hard to get out of,” Chang said. In those two months, China’s consumer price index fell by 0.7% and 0.1%, respectively, contrary to growth projections. This has been described by some researchers as the prelude to a deflationary spiral, which would “lead to lower production, falling wages, and rising unemployment.”

“And we also see some other numbers that look like China was actually contracting during the period. So for instance, tax receipts were down 3.5% that's not consistent with robust growth,” he added. “So we're seeing an economy that is being hit by the tariff dispute at a time when it is in trouble.”

Economists have long harbored doubts about the reliability of China’s economic numbers, but under President Xi, the Chinese government has stopped publishing hundreds of data sets previously used to calculate the health of China’s economy, the second largest in the world. In recent years, government ministries have stopped producing statistics on land sales, foreign investments, unemployment figures, and cremation rates.

In February of last year, Chinese President Xi Jinping signed an order to formally adopt revisions to a law on “Guarding State Secrets,” according to state media, CNBC reported. That national security law was broadened to conceal unclassified information, which economists say could easily sweep economic data and information into the dark corner of "state secrets." The cable network also quoted Jeremy Daum of

Yale Law School’s Paul Tsai China Center, who explained that "For foreign businesses, it’s the lack of clarity that will remain an unquantified risk to doing business in China."

The US-China Business Council notes that penalties for disclosing whatever is deemed a state secret range from three years' imprisonment to the death penalty.

Warning signs in the Chinese economy

There are warning signs for the Chinese economy beyond the ambit of official statistics that are much harder to conceal from domestic and foreign audiences alike.

For example, late last month, hundreds of Chinese factory workers took to the streets in protest over factory closures and economic uncertainty spurred by the tariffs, primarily demanding back wages after their workplaces came to a standstill. The discontent spread through diverse groups of workers from industries like construction, sporting goods and electronics—showing the breadth of the tariff impacts on the Chinese economy.

Before the protests, The Financial Times reported that factories across China had begun to slow production and furlough workers anticipating the effects of the tariffs. “Our export orders disappeared, so we’ve temporarily stopped,” one factory worker told the FT. The sentiment was echoed by several other workers interviewed by the outlet.

Aside from protests and layoffs, the Chinese government on Wednesday moved to cut key interest rates and implement other policy changes designed to juice a flagging economy and spur growth. These moves were part of a package of “10 coordinated monetary policy tools” released by the central bank that were designed to “promote high-quality economic development” during the “domestic and international economic and financial situation,” according to Chinese state media outlet Xinhua.

Among the changes announced by China’s central bank, the People's Bank of China, is a reduction in the reserve requirement ratio—the minimum amount a commercial bank must hold in reserve—by 50 points, which frees up an estimated 1 trillion yuan in liquidity. The bank also cut the lending rate for commercial banks by a quarter of a point and reduced the first-time homebuyer's five-year mortgage rate.

China is also continuing to endure a major crisis in its real estate sector, an industry which makes up close to a third of the country’s gross domestic product. The crisis began in 2021, following the collapse of two real estate giants, Evergrande and Country Garden, after the Chinese government implemented new policies to curb excessive debt among real estate developers.

Many Chinese real estate companies overbuilt in the country’s cities, leaving unfinished projects and empty buildings that, in some cases, the government has ordered to be torn down. Home prices have fallen significantly and major developers are still experiencing losses.

Chinese consumers have as much as 70% of their wealth tied up in real estate. Many local governments have also seen ballooning debts because of their over-reliance on property sales for revenue.

China is also suffering from a persistently high youth unemployment rate, which now stands at nearly 17%, almost double that of the United States. The figure is a signal of how well young Chinese are — or aren't — finding jobs after finishing their education, a proxy for the strength of the labor market.

Youth unemployment has been a concern of Chinese officials for years. After the rate reached a record high of 21.3% in 2023, the government temporarily stopped publishing the data. It resumed reporting later that year, debuting a new formula that it said better measured the statistic by excluding students.

China wants to approach Washington, but will be reluctant to admit it

Though China may have the capacity to fix its major, structural economic problems and sign a deal to reduce tariff rates, President Xi Jinping’s centralizing reforms may hinder changes in policy that could bring about those goals, Gordon Chang said.

“I think the Chinese understand that they got [sic] problems. The issue though…is the political system in China,” Chang said. "Xi Jinping has configured it [...] So he can't make an overture to the United States, which would be the rational thing for him to do, because he cannot appear weak.”

Perhaps because of China's long-standing cultural tradition of “miànzi”, which translates to "saving face," President Xi has been defiant in the face of the American tariffs. He said China is “not afraid” of a tariff war and warned the U.S. that “there are no winners in a trade war, and going against the world will only lead to self-isolation.” Chinese officials also described the tariffs as “unilateral bullying and coercion.”

Chinese leaders were also reportedly reluctant to reach out to the United States to start negotiations out of fears that they would appear weak. Instead, both sides are portraying their upcoming talks in Switzerland as a coincidence, according to Politico.

“I was going to be in Switzerland to negotiate with the Swiss,” Secretary Bessent said in an interview on Fox News. “Turns out the Chinese team is traveling through Europe, and they will be in Switzerland also. So we will meet on Saturday and Sunday.”

The Facts Inside Our Reporter's Notebook

Links

- is holding meetings

- Just the News, No Noise

- increasingly secretive with its economic data

- prelude to a deflationary spiral

- stopped publishing hundreds of data sets

- factories across China had begun to slow production

- moved to cut key interest rates

- according to Chinese state media outlet Xinhua

- a major crisis in its real estate sector

- 70% of their wealth

- seen ballooning debts

- which now stands at nearly 17%

- long-standing cultural tradition

- defiant in the face of the American tariffs

- both sides are portraying