Bipartisan bill would require IRS to notify taxpayer if seeking private financial info

Taxpayers will have more control over how the Internal Revenue Service acquires their personal information if a newly-introduced bill becomes law. The bill does include an exception, however.

(The Center Square) -

Taxpayers will have more control over how the Internal Revenue Service acquires their personal information if a newly-introduced bill becomes law.

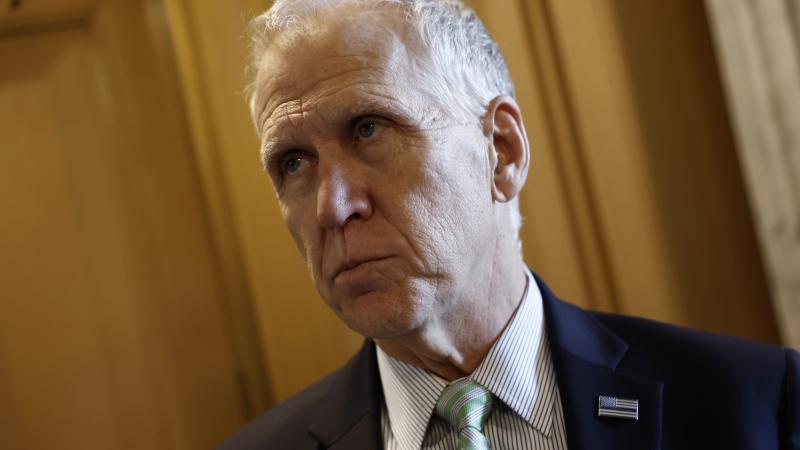

The bipartisan Taxpayer Notification and Privacy Act, brought forward Thursday by Sens. John Barrasso, R-Wyo., and Raphael Warnock, D-Ga., would require the IRS to inform taxpayers of the exact tax information it plans to seek from third parties, such as employers or banks, at least 45 days before doing so.

During that time period, taxpayers would have the option to provide the IRS directly with their personal financial information (used to calculate whether a person owes taxes) rather than have third parties – such as their bank or employer – do so.

According to Warnock and Barrasso, the bill is meant to protect taxpayer privacy and reputation and increase IRS transparency.

“[T]axpayers shouldn’t have to worry about the Internal Revenue Service (IRS) soliciting personal financial information behind their backs. They deserve to have the option to provide this sensitive information to the IRS directly,” Barrasso said.

“By providing that opportunity, our bipartisan bill will safeguard the reputation of taxpayers and small business owners across the country. It will also force the IRS to be as transparent as possible when it comes to the privacy of hardworking Americans,” he added.

Currently, if the IRS contacts third parties for tax information, it needs to notify the taxpayer that it is doing so, but it does not need to reveal which information it is seeking or from which entities. If passed, the bill would change that within 12 months of its being enacted.

The bill does include an exception, however. If the IRS determined that the information sought from a third party “is necessary notwithstanding whether the taxpayer could independently provide such information,” the IRS would not be subject to the extra reporting requirements stipulated by the bill.

It is unclear how the changes would affect overall IRS processing times or whether the legislation would increase agency costs. The IRS is already changing multiple sections of the tax code due to the recent passage of the Republican budget reconciliation bill, which implemented several temporary new tax deductions and credits.