Americans want accountability in DC. A key lawmaker is pressing IRS to deliver a healthy dose

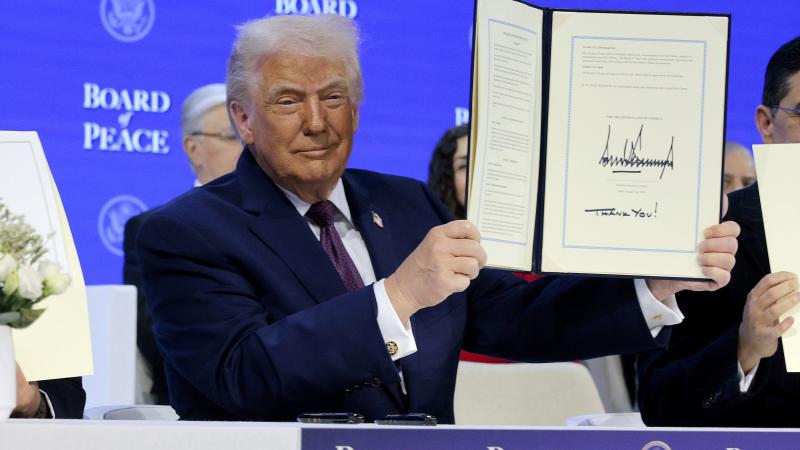

President Trump‘s choice to head the IRS, Billy Long, was just confirmed and took control of the agency.

When Donald Trump won the presidency last November, his vast base of voters were counting on a healthy dose of accountability to be delivered in Washington for the weaponization of government, the misuse of taxpayer funds and the violence and intolerance imposed on America's streets and college campuses.

But five months into the 47th presidency, there hasn’t been a wave of indictments or firings or even a massive release of long-awaited documents.

While there are hints that some of those deliverables may be on the horizon, one of the most powerful lawmakers in Congress is banking on an unexpected agency to deliver a round of consequences: the IRS.

House Ways and Means Committee Chairman Jason Smith, a Republican from Missouri, told Just the News that he has referred 11 nonprofit groups to the IRS to have their tax-exempt status stripped for fomenting division, hatred, intolerance, and violence on America’s streets and college campuses.

And after a prolonged period of time when the IRS was without a confirmed leader, Smith now believes newly installed IRS chief Billy Long, a former congressman himself, will act on those requests and deliver some meaningful consequences to those that have antagonized America.

“This is something that we have been researching at the Ways and Means Committee for over a year now. In fact, I have called for 11 different nonprofits to have their tax-exempt status reviewed and revoked,” Smith said during a wide-ranging interview Wednesday night on a Just the News TV special report produced in partnership with the Association of Mature American Citizens (AMAC).

“Unfortunately, during that timeframe, we have had numerous IRS commissioners go in and out. We're currently on the sixth one in the last nine months. But I am so thrilled that this is the first one that is President Trump's confirmed pick, Congressman Billy Long, my former colleague from the state of Missouri.”

Smith said the first nonprofits he has referred for investigation by the IRS have been “funneling money to organizations, but also that have been funneling money to create discontent and unrest, whether it's on college campuses or whether it's on the streets.

“They are protesting against ICE or obstructing ICE and they need to be held accountable,” he added. “That is not their tax-exempt status fulfillment. And so I think the IRS should eliminate their tax-exempt status.”

Smith isn’t just any member of Congress. As the chairman of the House Ways and Means Committee that controls taxes and the IRS, he wields vast influence over the agency.

Two years ago he came to the assistance of two IRS whistleblowers who claimed they were retaliated against when they objected to political interference in the tax investigation of Hunter Biden.

Smith’s intervention protected the careers of the two IRS agents and led to a dramatic reversal in the Hunter Biden case, prompting a sweetheart plea bargain to be canceled, and leading to two separate prosecutions and convictions of the first son before his father, Joe Biden, pardoned him last December.

Some of Smith’s Republican colleagues are also examining other ways to use the tax code to create punishments for those who get tax breaks and then cause harm in the United States.

Late last year, the House passed legislation from New York Rep. Claudia Tenney that would revoke the tax-exempt status of U.S. nonprofits found to be materially supporting terrorist organizations.

More than 180 House Democrats voted against the bill and it died in the Democrat-controlled Senate before Republicans took over that chamber in January.