China committee outlines roadmap to rare earths independence for America

The committee proposes federal financing, tax credits, permitting reform, and price floors to combat China’s market manipulation and industry dominance.

A new House report finds that Communist-run China’s dominance of the world’s rare earth mineral industry is far more elaborate than previously known and provides a roadmap on how the U.S. can stop – or at least slow – the effort by its biggest global economic competitor to prevent the U.S. from breaking into the market.

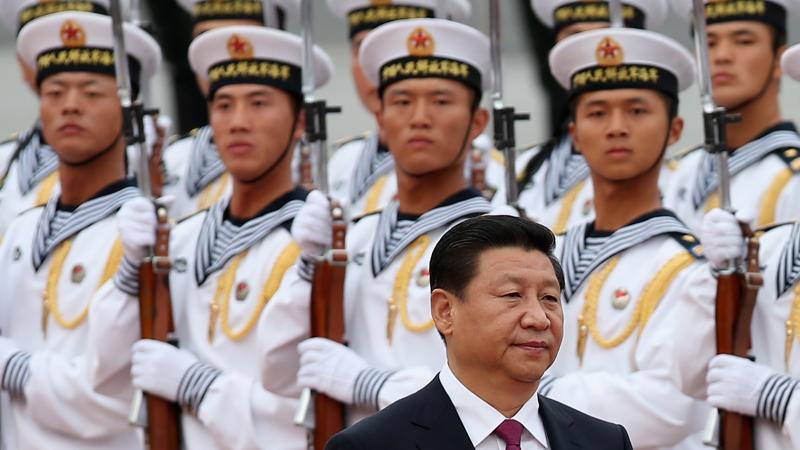

U.S. efforts to understand and reverse China’s supremacy in the global rare earths market have garnered new urgency in recent months in the midst of the ongoing trade war between Washington and Beijing. The Chinese Communist Party has used its advantage in the industry repeatedly to gain leverage in the trade talks, exploiting the United States’ vulnerability.

The new report from the House Select Committee on China aimed to lay out how China gained dominance in the supply of rare earths through a decades-long effort. Rare earth metals are vital for advanced manufacturing and technology, from smartphones to LED lights, and computer hard disks to key defense technologies, making Chinese control of the industry a major threat.

The committee proposes a roadmap for restoring America’s ability to compete and reverse its critical dependence on Chinese supply chains, furthering the work that President Donald Trump and his administration have already done to do so.

President Trump's trip to Asia last month was in large part focused on shoring up the U.S. weaknesses in rare earths by encouraging allied countries to help America develop an alternative to China’s markets, Just the News previously reported.

"From cell phones to fighter jets, every American is dependent on minerals that China manipulates for its own selfish interests. As we saw last month with its rule on rare earths, China has a loaded gun that is pointed at our economy, and we must act quickly,” China Committee Chairman John Moolenaar, R-Mich., said in a statement. “China’s predatory practices have caused American job losses, driven American miners out of business, and jeopardized national security.”

The urgency is bipartisan.

“Last month, with the announcement of its new rare earths export control regime, the CCP showed just how dangerous our dependence has become. Working with our allies around the world and environmental and labor rights stakeholders, America must usher in a new chapter when it comes to critical minerals and rare earths," Ranking Member Raja Krishnamoorthi, D-Ill., also said.

What can be done?

The China committee made 13 policy recommendations that its members believe would help restore the United States’ ability to compete with China in the rare earths industry.

To combat Chinese subsidies and market manipulation, the committee recommends the U.S. implement “temporary minimum price levels” on rare earths. This would “prevent unfairly priced imports from undermining American industries” and make prices accurately reflect market costs.

The U.S. should also use a mixture of federal financing, tax credits, and reforming the permitting process for new mines to jumpstart critical mineral production within the United States, the committee said. These could include low cost loans from government lenders that would provide enterprises the necessary capital to jumpstart projects.

The committee also recommends the U.S. build a strategic reserve of critical minerals patterned on the strategic oil reserve that would allow the country to access vital metals in an emergency without relying solely on foreign supply chains.

China’s subsidies & controls built dominance

The committee, which undertook an effort to understand the Chinese critical minerals industry and how the Communist-run country came to dominate in it, concluded that the American reliance on marketplace competition with Chinese rare earths firms has put the country at a disadvantage precisely because China does not play by the same rules.

In fact, the Chinese view the rare earths as a strategic resource and not commercial commodities to buy and sell. “Former [Chinese president and Communist Party chairman] Deng Xiaoping captured the PRC’s strategic view of rare earths with the 1992 quote ‘There is oil in the Middle East, there is rare earth in China’,” reads the committee’s report.

To this end, the committee found that China has engaged for years in substantial market manipulation to secure its rare earths dominance, including through the use of government subsidies, price controls, infiltration of “Price Reporting Agencies” that help determine the global prices of such metals.

China has pumped nearly $57 billion in aid and subsidized credit into mineral projects both inside and outside of China. According to a report from the U.S. Export/Import Bank, many Chinese state lenders offer loans to mining companies at zero or negative interest rates for certain critical minerals. In contrast, financial institutions in Western countries rely on market-based financing, putting them at a disadvantage, the committee concluded.

The Chinese government also makes efforts to control rare earths pricing to undermine global competition. The committee found that under Chinese law, the government can closely control prices in the rare earths industry by using government-guided price schemes and penalizing companies that “fabricate and spread information about price hikes,” which is completely subjective to the determination of officials.

The report outlined efforts by the Chinese government to consolidate control over the rare earths industry which took place over decades. After Beijing declared rare earths to be strategic and protected minerals under law in the 1990s, Chinese companies worked to “lure in” technologically more advanced Western competitors “through partnerships or acquisitions.” Once the Chinese firms learned about Western operations, they would buy out and shut down competitors abroad, the committee found.

Rare earths are now China’s weapon

Now, Beijing’s stranglehold on the rare earths industry is near complete. The nation controls 60% of mining and more than 90% of refining worldwide, according to the International Energy Agency in 2025, far ahead of the United States’ approximately 12% share.

The Chinese have exploited this advantage to extract concessions from the United States during sometimes tense trade negotiations with the Trump administration. For example, China announced sweeping export controls on a slate of rare earth minerals, tightening the screws for the United States ahead of the meeting between the countries’ two leaders last month.

At that meeting, Washington and Beijing agreed on a trade truce, with the Trump administration promising reduced tariff rates and Beijing agreeing to back off mineral export controls.

Trump has a head start

The Trump administration has already taken action on several of these issues in an attempt to reverse the decades-long decline of the U.S. rare earths industry compared to China.

President Trump’s recent trip to Asia last month was in large part focused on shoring up the United States’ rare earth weaknesses. Trump signed three agreements with two Southeast Asian nations and Japan during his swing through the region this week. Each included promises to collaborate on the extraction and refining of rare earth elements in China’s own backyard.

The agreement with Japan is the most comprehensive. Both parties promised to coordinate “support for the supply of raw and processed critical minerals and rare earths” that are vital to each country’s industries.

However, experts assess that it will take years for the United States to build up supply chains independent of China, even with government investment.

"China's dominance is truly massive," Daan Struyven, Goldman Sachs co-head of global commodities research, said in a podcast last month. "It's going to take years to build up independent supply chains in the West.”

Ryan Castilloux, geologist and founder of Adamas Intelligence, said that, even with “sustained policy and investment momentum,” the U.S. and its partners would need between 10 and 15 years to have enough “breadth and depth” to sustain demand independent of China.

It is for this reason that the Trump administration has pushed China to back off of its rare earths export controls in the deal it signed last month.

The Facts Inside Our Reporter's Notebook

Links

- new report from the House Select Committee on China

- are vital

- focused on shoring up the U.S. weaknesses in rare earths

- said in a statement

- also said

- view the rare earths as a strategic resource

- the committee found that China has engaged for years in substantial market manipulation

- pumped nearly $57 million in aid and subsidized credit

- control rare earths pricing

- International Energy Agency

- have exploited this advantage

- agreed on a trade truce

- signed three agreements

- agreement with Japan is the most comprehensive

- said in a podcast last month

- said that