Trump focuses Asia trip on rare earths, goal to make U.S. independent from China's supply dominance

The president's agreements with close allies and economic partners alike provide an opening for the U.S. to develop its own critical supply chain. That pipeline of rare earths — considered strategic materials — is mostly dominated by China.

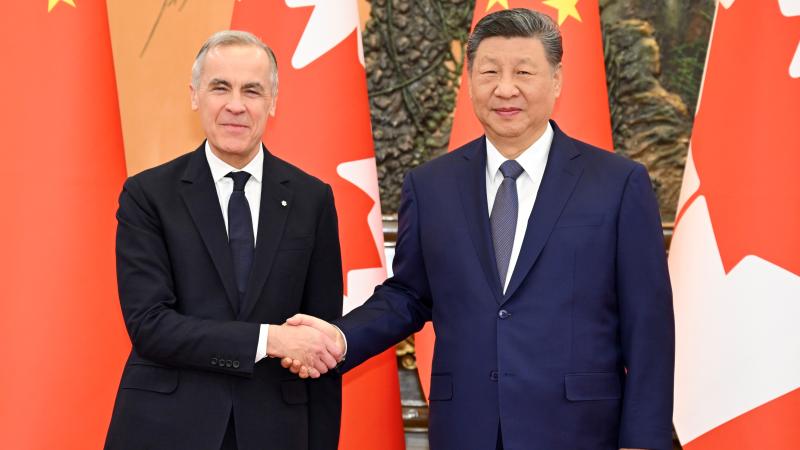

President Donald Trump left for Asia on a mission to cement the United States’ trade and security relationships before a key meeting with Chinese President Xi Jinping. He has also used the opportunity to shore up a weakness that China has exploited in trade talks: the supply of rare earths.

China’s overwhelming dominance in rare earth elements mining and refining has given it near-veto power over global industries that depend on the metals. It has used this lever repeatedly during sometimes tense trade negotiations with the Trump administration to gain leverage, highlighting the United States’ vulnerability.

But, new deals inked by the president on his marathon trip to Asia this week provide an opening for countries to develop an alternative to the Chinese rare earth market. The agreements with several Southeast Asia countries, Japan, and earlier, Australia, send a clear message before President Trump is set to meet with his Chinese counterpart in South Korea on Thursday.

“These [deals] present tremendous opportunities,” economist Diana Furchtgott-Roth, Director at the Center for Energy, Climate, and Environment at the Heritage Foundation, told the John Solomon Reports podcast.

“President Trump is going out and making deals with these countries, and he is also opening up areas within the United States where we can drill and explore for our own critical minerals. We do have critical minerals here in the United States, but under the previous administration, there was an unwillingness to tap them, and we have access,” she said.

Rare earth elements are a family of 17 metals that have similar properties that are especially valuable to the modern economy. The metals are used in much of advanced manufacturing and technology, from smartphones to LED lights, and computer hard disks to key defense technologies.

Much of modern life would simply not be possible without a steady supply of these rare earth elements. And that is what has made its significant control over the industry a potent tool for China.

China has used its near-total dominance in the rare earths industry to keep U.S. tariffs at bay and to generate leverage in its ongoing trade negotiations with Washington with great effect. Earlier this month, China announced sweeping export controls on the vital minerals tightening the screws for the United States ahead of the meeting between the countries’ two leaders.

The new measures were the most wide-ranging of the tit-for-tat export restrictions related to chips and rare earth minerals imposed by both the United States and China that date back to the Biden administration.

China controls 90% of rare earth refining worldwide

The industry is a key pain point for the U.S. ahead of trade negotiations because the American industry lags far behind China in rare earth extraction and refining. The nation controls 60% of mining and more than 90% of refining worldwide, according to the International Energy Agency in 2025, far ahead of the United States’ approximately 12% share.

Though currently thin on details, Trump signed three agreements with two Southeast Asian nations and Japan during his swing through the region this week. Each included promises to collaborate on the extraction and refining of rare earth elements in China’s own backyard.

Seeking help from Australian and Asian allies

The agreement with Japan is the most comprehensive. Both parties promised to coordinate “support for the supply of raw and processed critical minerals and rare earths” that are vital to each country’s industries.

Both Japan and the United States agreed that they would “jointly identify” rare earths projects in which to invest, streamline permitting processes, and work towards creating stockpiles of strategic minerals, according to the text of the agreement published by the White House.

The agreements with Thailand and Malaysia are scant on details but include promises to cooperate on efforts to diversify rare earths supply chains. Malaysia pledged not to impose quotas or ban rare earths exports to the United States and in return promised market access for U.S. goods. The Thailand memorandum is aimed at encouraging business partnerships in exploration, development and processing of critical minerals, the South China Morning Post reported.

The rare earths agreements build on a framework the American president signed with Australia last week. In that agreement, Australia and the U.S. aim to boost the supply of critical minerals available to both countries by investing up to $8.5 billion in "ready-to-go" projects. One billion of that will be invested in projects in the U.S. and Australia in the next six months, BBC News reported.

President Trump seemed confident that the deal would reverse the alliance's rare earths fortunes. He said during Australian Prime Minister Anthony Albanese's visit to the White House last week that "in about a year from now we'll have so much critical minerals and rare earths that you won't know what to do with them.”

However, the timelines remain uncertain.

Ten to twelve years for U.S. to catch up, expert says

"China's dominance is truly massive," Daan Struyven, Goldman Sachs co-head of global commodities research, said in a podcast last week. "It's going to take years to build up independent supply chains in the West.”

Ryan Castilloux, geologist and founder of Adamas Intelligence, said that, even with “sustained policy and investment momentum,” the U.S. and its partners would need between 10 and 15 years to have enough “breadth and depth” to sustain demand independent of China.

“The US currently imports around 10,000 tonnes of rare earth magnets annually from China, Europe imports more than 25,000 tonnes,” Castilloux told Al Jazeera. “In both regions, demand for magnets is growing strongly – these figures will grow by multiples over the next 10 years.”

It is for this reason that the Trump administration has tried to push China to back off of its rare earths export controls. The two countries negotiated a tariff truce after China’s first round of restrictions earlier this year.

After a meeting between senior U.S. and Chinese officials in Malaysia over the weekend, U.S. Treasury Secretary Scott Bessent said he believes Trump and Xi can come to “some kind of deferral” on those rare earths export controls.

At the same time, Xi Jinping and the Chinese have been loath to cede bargaining chips in the trade war without putting up a fight, as it did with both the Panama Canal and TikTok.

The Facts Inside Our Reporter's Notebook

Links

- Director at the Center for Energy, Climate, and Environment

- a family of 17 metals

- used its near-total dominance in the rare earths industry

- China accounted for 69% of the world's production

- agreement with Japan is the most comprehensive

- pledged not to impose quotas or ban rare earths exports

- aimed at encouraging business partnerships

- aim to boost the supply of critical minerals

- said in a podcast last week

- Castilloux told Al Jazeera

- Secretary Scott Bessent said

- the Chinese have been loath to cede bargaining chips