IRS retaliation, incompetence show why it shouldn't get donor identities, nonprofits tell judges

IRS can't even explain why it needs donor identities to do its job and has terrible track record, diverse nonprofits tell 6th Circuit. It hid leak from victim Young America's Foundation until nearly a year after contractor's conviction.

As the Supreme Court weighs whether to let New Jersey pro-life pregnancy centers challenge their Democratic attorney general in federal court before he can unmask their donors, a massive cross-ideological coalition is fighting to stop the Internal Revenue Service from doing the same thing to advocacy groups at odds with any given occupant of the White House.

More than 250 groups joined friend-of-the-court briefs supporting Ohio's Buckeye Institute, which endured an IRS audit shortly after it lobbied state leaders to reject President Obama's Medicaid expansion in 2013, against unmasking of the center-right think tank's donors.

They include progressive groups such as People for the Ethical Treatment of Animals, National LGBTQ Task Force Action Fund and American Atheists, and conservative heavyweights such as 18 Republican AGs, Moms for Liberty and Americans for Tax Reform.

Fearing "retaliatory individual audits or other such government antagonism" if the IRS identified them from Buckeye records, some donors "stopped giving entirely, and others began making smaller, anonymous, cash donations," giving up tax deductions to "avoid any personal political retribution" for their giving, the institute says.

While the docket conspicuously shows no Democratic elected official has yet filed a brief, it was the Trump administration that appealed to the 6th U.S. Circuit Court of Appeals after a trial court rejected both parties' motions for summary judgment, continuing its predecessor's legal arguments and putting it at odds once again with President Trump's base.

Trump's DOJ sided with New Jersey pro-life pregnancy centers against state Attorney General Matthew Platkin, however, on the narrower question of whether they must wait for state-court proceedings to conclude before going to federal court, risking the so-called preclusion trap that would preempt a federal challenge. Liberal groups also backed the centers.

The 2nd Circuit recently affirmed a preliminary injunction for New York pro-life pregnancy centers that prevents their Attorney General, Letitia James, from enforcing consumer fraud laws against their promotion of so-called abortion pill reversal, letting them seek relief in federal court and finding they were likely to succeed on the merits of the First Amendment suit.

It's the Democrat's latest loss in her attempts to muzzle pro-life speech that "makes biological sense," as an Ivy League reproductive health researcher once described abortion pill reversal, or the use of supplemental progesterone to counteract mifepristone. James received better news this week: A grand jury refused to indict her again for mortgage fraud.

Tax exemptions, deductions 'gestures of legislative grace'

The IRS has long faced accusations of politically motivated actions against conservative nonprofits, including questionably timed audits and withholding of tax-exempt status.

The controversies continued through this fall, with the Justice Department settling with IRS whistleblowers who alleged the new administration was still retaliating against them for claiming Hunter Biden received special IRS treatment in his father's lone White House term.

DOJ's opening brief to the 6th Circuit argues that the 2021 SCOTUS ruling against California's compelled disclosure of donor identities as a First Amendment violation doesn't apply to the "substantial-contributor reporting requirement" in federal law for most 501(c)(3) tax-exempt groups, because the latter is "voluntary" and "rationally related to the tax benefit."

It called tax deductions and exemptions "gestures of legislative grace" in a system that relies on "self-assessment and voluntary compliance," and faulted the trial court for applying the "exacting-scrutiny standard" to a law nearly 60 years old rather than the "rational-basis standard applicable to conditions on voluntary government subsidies."

Funding conditions are subject only to the lower legal standard sought by DOJ "when they limit how federal funds are used," the Institute for Free Speech responded on behalf of the Buckeye Institute. This "proposed tax-benefit exception to the Constitution transforms the tax code into the supreme law of the land."

Buckeye argues that donor disclosure "is not substantially related to any sufficiently important government interest and the government has more narrowly tailored alternatives."

The Foundation for Individual Rights and Expression led the brief that includes progressive groups among a hodgepodge of religious, pro-life, medical and creative groups, from the culinary-focused James Beard Foundation to the Comic Book Legal Defense Fund.

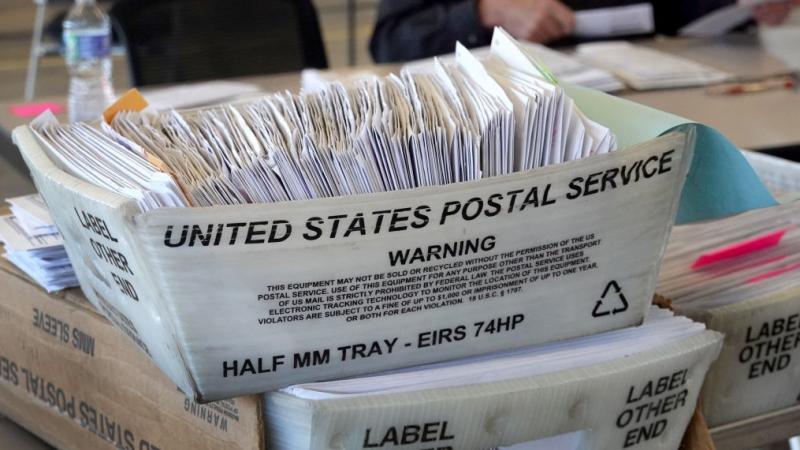

The IRS "voluntarily" got rid of disclosure for other tax-exempt 501(c) groups after "determining it does not need confidential donor information to administer the tax laws," and it concedes it has repeatedly disclosed such information unlawfully to the public and that there's an ongoing risk due to redaction difficulties, leaks and "cybersecurity issues," the brief says.

Especially when "the political winds of executive agencies" shift between administrations, "the risk of threats, harassment, reprisals, and even political targeting by government based on one’s association with certain causes shifts as well, which is especially worrisome for supporters of charities working on controversial or unpopular issues," the brief also says.

IRS hid leak from conservative victim until long after felony conviction

More than half of the 250 groups supporting Buckeye are on a single brief led by Advancing American Freedom, including Americans for Tax Reform, Democrats for Life, Moms for Liberty, Southeastern Legal Foundation and American Conservative Union Foundation.

The brief emphasizes the substantial-contributor trigger is just "an aggregate total of $5,000 per tax year" if that constitutes more than 2% of donations the group receives. The IRS wants to impermissibly condition tax exemption on "sacrificing a constitutionally protected right without that condition facing heightened scrutiny" in the courts.

The government "cannot collect massive amounts of data about Americans merely for its own convenience," the brief says, quoting former AG William Barr's description of a Securities and Exchange Commission data collection program as a "big-brother surveillance state."

Since the 2021 SCOTUS ruling against California, "every state regulates charities without preemptive donor disclosures" of the sort the IRS explicitly seeks for the SCOTUS-rejected "deterrent effect," not even arguing it "increases its investigative efficiency," the Iowa-led brief of 18 GOP attorneys general says, accusing the IRS of trampling federalism.

All 50 state AGs "possess a law enforcement interest in preventing non-profits from defrauding their citizens," and not demanding "unredacted Schedule Bs" has not stopped the 18 on the brief "from effective oversight of non-profits," the brief says. Ten have gone even further by "not requiring any registration to raise funds in their jurisdictions."

While the 2021 SCOTUS precedent "did not yield a majority on the precise level of scrutiny that applies to such regulations," broader precedent demands the highest level of judicial scrutiny on "laws directly burdening the right to associate anonymously, including compelled disclosure laws," as for laws "burdening other First Amendment rights," another brief says.

The Center For Individual Rights, New Civil Liberties Alliance and Hamilton Lincoln Law Institute urged the court to apply strict scrutiny as opposed to exacting scrutiny, a lower standard "applicable primarily" to campaign finance, justified to dissuade "quid pro quo corruption."

Exacting scrutiny is wholly unsuited to 501(c)(3)s, which "must refrain from participating in electoral politics" and have faced "more than a dozen breaches of IRS data – to say nothing of the targeting of perceived political enemies by the IRS itself," the brief says.

Young America's Foundation, "with great consternation" and "in the context of a world in which conservatives are under attack broadly," discloses substantial contributors as a 501(c)(3) but "has always feared, and now has specific reason to believe," the IRS has not kept this information confidential, the conservative campus network's brief says.

"YAF’s legal initiatives are a primary reason for giving for many donors," yet the IRS waited nearly a year after a contractor's felony conviction – for leaking tax returns for hundreds of thousands of taxpayers to the media – to vaguely tell YAF the contractor was charged with "unauthorized inspection or disclosure" of three years of YAF's return information.

Victims were robbed of both their privacy and "the right to participate in the prosecution as victims," and YAF questioned whether it should even file in the Buckeye case, since "the IRS compromise of our data was relatively unknown" and going public might chill its donors, but YAF decided it must show the court the real-world harm from Schedule B disclosure.

The Facts Inside Our Reporter's Notebook

Videos

Links

- pro-life pregnancy centers challenge their Democratic attorney general

- More than 250 groups joined

- lobbied state leaders to reject

- Trump administration that appealed

- at odds once again with President Trump's base

- Trump's DOJ sided with

- preclusion trap that would preempt

- Liberal groups also backed the centers

- 2nd Circuit recently affirmed a preliminary injunction

- Democrat's latest loss in her attempts to muzzle

- A grand jury refused to indict her again

- Justice Department settling with IRS whistleblowers

- new administration was still retaliating against them

- DOJ's opening brief to the 6th Circuit

- 2021 SCOTUS ruling against California's compelled disclosure

- Institute for Free Speech responded

- Foundation for Individual Rights and Expression

- Advancing American Freedom

- former AG William Barr's description

- Iowa-led brief of 18 GOP attorneys general

- Center For Individual Rights, New Civil Liberties Alliance

- Young America's Foundation

- contractor's felony conviction