HBO show to receive largest ever film tax credit in Pennsylvania

State awarding the HBO TASK production a $49.8 million tax credit, roughly half the state’s 2025-26 budget for the program.

(The Center Square) -

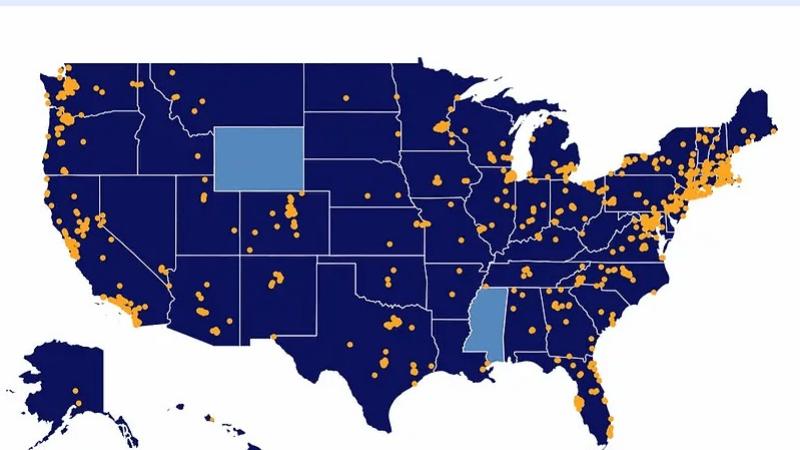

Los Angeles, New York City, Vancouver, Philadelphia? With the announcement of a second season of HBO’s TASK, the commonwealth is hoping to draw attention to the perks of making films in Pennsylvania.

Pennsylvania Film Commissioner Gino Anthony Pesi announced Monday that his office would be awarding the production a $49.8 million tax credit, roughly half the state’s 2025-26 budget for the Film Production Tax Credit Program.

While the state’s film budget pales in comparison to locations like California and New York, the tax credit program opens the door for competition with neighboring states like New Jersey to host new projects. HBO anticipates the production will create 3,700 jobs, add more than $194 million to the economy and amount to 25,000 hotel nights.

“This is the largest tax credit we’ve ever awarded to one show, and we’re proud to support another returning series by homegrown storyteller Brad Ingelsby through the Film Production Tax Credit Program,” said Pesi. “The Shapiro Administration understands that supporting productions like TASK have a powerful impact on Pennsylvania’s creative economy through the creation of thousands of direct and indirect jobs, while also giving new opportunities to local businesses in the southeastern region.”

The crime drama is set in the Philadelphia area and was created by Chester County native and Villanova graduate Brad Inglesby whose Mare of Easttown brought widespread attention to Delaware County.

Executive Vice President of Production at HBO, Janet Graham Borba, said that shooting on-location adds an “invaluable level of authenticity to the series.”

“I am thrilled to be filming another season of TASK in my home state of Pennsylvania,” said Ingelsby. “I’m deeply grateful that I get to tell stories about characters from this very specific part of the country while working alongside the wonderful people who also call Pennsylvania home.”

The tax credits awarded to film productions are the result of reductions in owed taxes like Personal Income and Corporate Net Income Taxes. To qualify, a film must spend at least 60% of its total budget in the state.

But critics argue the commonwealth's investment in film tax credits hasn’t delivered the economic returns policymakers had anticipated.

In its five-year review published in 2023, the Independent Fiscal Office said the program’s $8.5 million net tax revenue does accomplish its legislative intent, even if tens of thousands of dollars in potential profit seep out of the state in the meantime.

That’s because 95% of tax credits are transferred or sold, rather than used by their recipients. Those credits are usually sold at 93 cents to 94 cents on the dollar, reflecting a leakage of 6%-7%.

Anthony Hennen contributed to this report.