Hyundai details $6B steel mill in Louisiana, commitment to 'hydrogen economy'

The proposed mill is projected to be operational by 2029, but company officials acknowledged significant challenges ahead, including the high cost of hydrogen production and uncertainty around future federal tax incentives.

(The Center Square) -

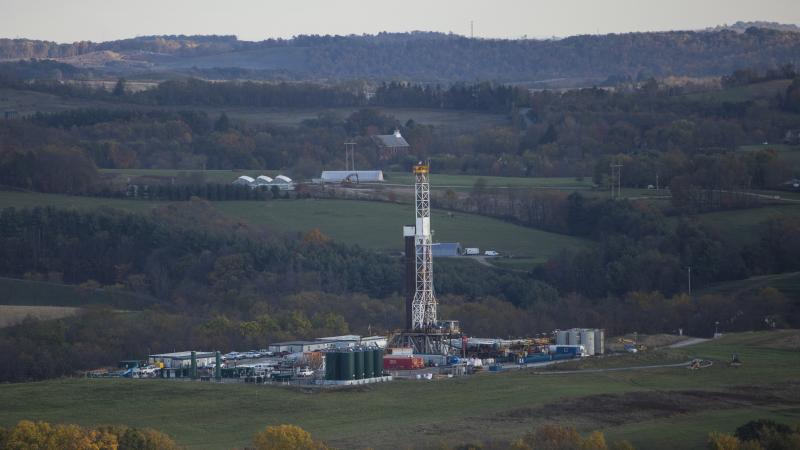

(The Center Square) − Louisiana's Clean Hydrogen Task Force on Monday was briefed by Hyundai officials outlining their $6 billion vision for a hydrogen-integrated steel mill in Ascension Parish — what the company called a "catalyst for the hydrogen ecosystem" in the state.

The proposed mill is projected to be operational by 2029, but company officials acknowledged significant challenges ahead, including the high cost of hydrogen production and uncertainty around future federal tax incentives.

"Until we get these prices down, a smart investor or business person can't make some of these investments," said Mark Zappi, executive director of the Energy Institute of Louisiana.

Hyundai North America Senior Vice President Jim Park reaffirmed the company's commitment to the project despite changes to federal policy. When asked if the rollback of hydrogen production tax credits in President Donald Trump's proposed "Big Beautiful Bill" might slow progress, Park responded that Hyundai had an "unwavering commitment to the "hydrogen economy."

The company framed the integrated steel mill as the first step in developing Louisiana into a national hydrogen leader. Hyundai described a three-stage strategy beginning with fostering hydrogen demand at the steel mill, expanding adoption across other industrial sectors and lastly building a statewide hydrogen ecosystem.

"Hydrogen presence across industries [will help] decarbonize business practices," Hyundai said, adding that investment across the hydrogen value chain could secure Louisiana's position as an energy transformation leader.

The plant is expected to drive job creation, workforce training, and "inclusive economic development," while reducing millions of tons of carbon emissions over the coming decades.

Hyundai also emphasized the role of state-level economic incentives, like Louisiana's Industrial Tax Exemption Program and Quality Jobs Program, in attracting and accelerating clean energy investments.

"To enable and catalyze this economy, economic development incentives and greater certainty are key factors in accelerating adoption," Park said. "If you want to really develop economically and have more companies join the party, those types of incentive packages do work."

Hyundai also detailed a five-level roadmap for decarbonizing steel production. The company's long-term goal is to produce "green steel" using hydrogen sourced from renewable energy — a method with a carbon footprint of less than 0.1 tons of CO2 per ton of steel. In contrast, traditional blast furnaces emit between 1.5 and 2.5 tons of CO2 per ton of steel.

Hyundai plans to launch operations using blue hydrogen, which involves capturing and storing CO2 emissions from hydrogen made via natural gas. This intermediate step would later transition to green hydrogen, which produces virtually no emissions when powered by renewables or biomass.

Zappi broke down the cost hierarchy for hydrogen fuels.

Gray hydrogen, the most carbon intensive, is the cheapest and is produced from natural gas via steam methane reforming. Blue hydrogen adds 50 to 75 cents per kilogram due to carbon capture costs, while green hydrogen can be three to four times as expensive as gray.

Hyundai's internal projections highlight the rapid expected growth in green steel. According to the company, the U.S. green steel market is expected to grow at 8.5% annually through 2034, more than double the growth rate of conventional steel.

"This project is not just about producing steel — it's about producing a better future," Hyundai concluded in its presentation.