Iran threatens to disrupt global energy markets, but its ability to do so is limited, experts say

Will Iran take the gamble? Closing the Strait of Hormuz would cause a brief but huge disruption for the world’s energy markets, experts say, but such a drastic move would not be without consequences for Iran.

In retaliation for the U.S. strikes on three nuclear facilities, Iran threatened to close the Strait of Hormuz. From this one waterway, which is 21-miles wide at its narrowest point, comes 30% of the globe’s seaborne oil trade and 20% of the global liquefied natural gas trade.

Closing the strait would cause a huge disruption to the world’s energy markets, experts say, but such a drastic move would not be without consequences for Iran. However, Victoria Coates, former deputy national security advisor, said on the “Furthermore with Amanda Head” podcast that nothing is for certain.

“Everybody needs to be really cautious right now on both sides of this debate about either spiking the President or spiking the football. We just don't know what's going to happen next,” Coates said.

Investors betting against Iran trying it

Hours after the U.S. bombing, the Iranian Parliament voted to close the strait, but before that could happen, Iran’s Supreme National Security Council would have to approve it. Robert Rapier, a chemical engineer and editor-in-chief of Shale Magazine, called it “Iran’s nuclear option” that would represent a “substantial escalation” in the conflict. He said the impacts on global markets would be comparable to those of the Russian invasion of Ukraine. But it’s unlikely Iran will go that far.

“They threatened to close it before, and haven't done it. And it's never been closed in modern history,” Rapier told Just the News.

The market appears to be betting that Iran won’t try it. Andy Fately, principal at FXP Hedge Consultants, pointed out in his “FX Poetry” Substack that, while there was an expected oil price increase, it was only an early 2.2% gain.

“It’s pretty lackluster for the alleged (by some) beginning of” World War III, Fately wrote. Other market indicators, he noted, lacked any dramatic spikes, suggesting the “collective wisdom” of the market is not predicting escalation. Rapier agreed the market response suggests analysts aren’t predicting the conflict to go much further.

“I think that's the market saying, 'We don't expect them to close it, and we don't expect much further escalation,'” Rapier said.

Limited capability, limited options

The other question being asked is whether Iran has the capability to close one of the world’s key energy arteries, which would certainly get a quick response. David Blackmon, an energy analyst who publishes his work on his “Energy Absurdities” Substack, told Just the News that the U.S. would likely step in to counter any naval blockade in the strait, and Iran lacks the naval power to counter that.

“It's questionable whether Iran even has the capability to close the strait at this time, even temporarily, but I think it's pretty obvious that even if they tried to do that, they'd quickly be blown out of the water,” Blackmon said.

On Monday, Iran launched missiles at a U.S. military base in Qatar, Axios reported. So far there have been no reports of any casualties or damage from the attack, and it’s unclear that the missiles got past defense systems. The action may have done little more than reveal Iran's limited capabilities. Blackmon said in a post on X that following the news of the attack, U.S. and European benchmark oil prices dropped.

Still, assuming that Iran wants to mine the Strait of Hormuz, some experts say it is possible, whether a good idea or not. The non-profit Atlantic Council says that "Iran possesses approximately five thousand to six thousand naval mines, according to US intelligence estimates. Iran has the capability to deploy large quantities of these mines in the narrow passage of the Strait of Hormuz shipping lane. Immediate deployment could occur via Iran’s roughly twenty-five submarines."

The Council also says that: "This fleet reportedly includes three Russian Kilo-class vessels and around twenty-three domestically produced Ghadir-class mini-submarines. Even the threat of Iranian mines has the potential to halt commercial traffic within days [...] But in the face of a determined US response, Iran is not capable of completely closing the Strait."

Friends in no places

Russian President Vladimir Putin was initially silent following the U.S. bombing of Iran, but on Monday, he called the attacks “unjustified” and said Russia was “making efforts to assist the Iranian people,” Reuters reported. Closing the strait would also cut off energy supplies to Asia, including China, which by some estimates buys 90% of Iran’s crude oil.

Coates, speaking on the “Furthermore with Amanda Head” podcast, said that Russia is stretched thin with its war in Ukraine, and they don’t have access to the bases in Syria that they had a year ago.

Iran isn't likely to get much help from China, either. Closing the strait would also cut off energy supplies to Asia, including China, which by some estimates buys 90% of Iran’s crude oil. Coates said China doesn’t have the capacity to, for example, steam a carrier group into the Persian Gulf.

“I'm wondering if maybe Iran is thinking about the friends they chose, and looking at the friends we have, and thinking that doesn't quite match up,” Coates said.

China has so far been silent. With China’s stake in keeping the Strait of Hormuz open, Rapier said, it’s likely they have an interest in the conflict coming to a close.

“We haven't seen anything out of China in support of Iran, and so they seem to be very isolated,” he said.

No more "kill switch" on the global economy

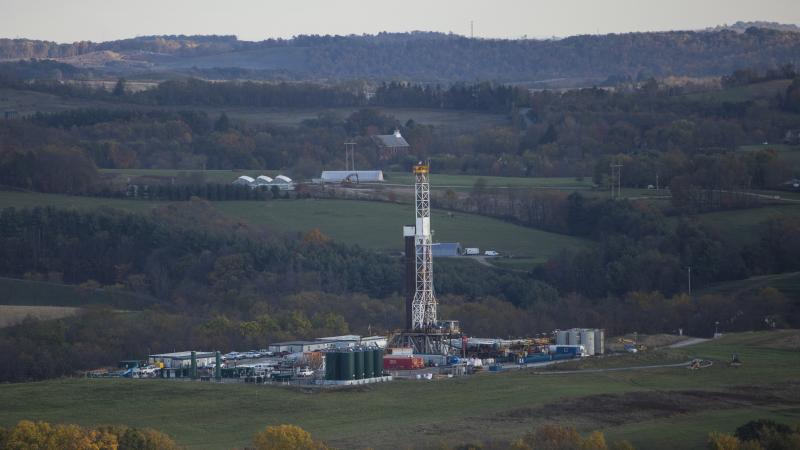

The impact of closing the strait, while substantial, is not as powerful as it was in the 1980s when much of the world’s oil came out of the Middle East. Today, the U.S. is the largest producer of crude oil and natural gas, and Canada is the fifth-largest producer of both. The rise of North American energy has broken the stranglehold that OPEC once had over the global market.

Writing in Forbes, Michael Lynch, president of Strategic Energy and Economic Research, said that swarms of drones, missiles and speedboats could significantly impede LNG and crude oil shipping in the Persian Gulf, which could send oil prices over $100 per barrel if shipping companies avoid the Gulf.

Coates pointed out that even if Iran could muster the ability to disrupt energy shipping over a long period of time to create a sustained rise in oil prices, ultimately it would create opportunities for American producers.

“I think the Ayatollah is realizing, ‘I no longer have my kill switch on the global economy,’” Coates said.

Rapier said that the Iranian regime will have to take retaliatory action, as the missile attacks on U.S. military bases demonstrated.

Iran's first goal: Avoiding regime change

“Imagine us getting bombed and not doing anything about it. I mean, we lose faith in our government, and that's probably what they're weighing over there,” Rapier said.

While some action was needed, history, Coates said, suggests that Iran will bow out before the conflict escalates much further. At the end of the 1980s Iran-Iraq War, Iran was losing the war, and the regime was threatened with annihilation.

“The then-supreme leader, [Ruholla] Khomeini said, ‘You know, we are going to drink the bitter chalice, make concessions and survive.’ And so if they are feeling that the combined efforts of Israel and the United States are threatening their survival, yes, I think there's a universe in which they dust off that old chalice and rerun that playbook in an effort to stay in power,” Coates said.

It would appear that Coates may have been correct. Trump announced Monday evening that a ceasefire between Israel and Iran would be phased in over the next 24 hours. That may bring the conflict to a close, at least for now.

The Facts Inside Our Reporter's Notebook

Links

- comes 30% of the globeâs seaborne oil trade

- 20% of the global liquefied natural gas trade

- Furthermore with Amanda Head

- Supreme National Security Council would have to approve it

- Shale Magazine

- Andy Fately

- FX Poetry

- Energy Absurdities

- Axios reported

- said in a post on X

- Reuters reported

- estimates buys 90% of Iranâs crude oil

- estimates buys 90% of Iranâs crude oil

- largest producer of crude oil and natural gas

- Writing in Forbes

- Michael Lynch

- 1980s Iran-Iraq War

- ceasefire between Israel and Iran