China clamps down on rare earth exports ahead of trade negotiations with Trump

The industry is a key pain point for the U.S., which lags far behind China on rare earth extraction and refining. The impacts could be far-reaching on the U.S. economy and security interests.

China announced sweeping export controls on vital rare earth minerals, battery components, and other industrial materials, tightening the screws for the United States ahead of the potential meeting between President Donald Trump and Chinese President Xi Jinping.

The new measures are the most wide-ranging of the tit-for-tat export restrictions related to chips and rare earth minerals imposed by both the United States and China that date back to the Biden administration. The industry is a key pain point for the U.S. ahead of trade negotiations because the American industry lags far behind China on rare earth extraction and refining.

Elements for strategic and military uses

In addition to further expanding the list of controlled rare earths, the Chinese are also extending restrictions on Chinese-made equipment abroad, specifically targeting potential military uses, and curbs on lithium-ion batteries—central to the growing electric vehicle industry currently dominated by China.

The restrictions, which were published in several installments by the Chinese Ministry of Commerce on Thursday, could have significant implications for the burgeoning American Artificial Intelligence industry and expose the true weakness of the American rare earths sector. Experts assess that the move is likely intended to build pressure on the U.S. ahead of a potential meeting between Trump and Xi in the coming weeks.

Flexing its rare earths muscles has been one of China’s only moves to stave off further tariff hikes by the Trump administration. In June, the Chinese imposed export controls on seven key types of rare earth metals, as retaliation against tariffs. The measures staved off further tariff escalations by the Trump administration and the country has settled into a temporary truce pending further negotiations.

"Lights out" for U.S. AI boom: Expert says

“This is a very big deal. China has asserted sweeping control over the entire global semiconductor supply chain, putting export license requirements on all rare earths used to manufacture advanced chips,” Dean Ball, senior fellow at the Foundation for American Innovation, posted to X.

“If enforced aggressively, this policy could mean ‘lights out’ for the US AI boom, and likely lead to a recession/economic crisis in the US in the short term,” he added.

Ball said that the move, which comes ahead of a potential meeting between Trump and Xi Jinping is likely aimed at creating leverage for the trade and tariff negotiations between the U.S. and China.

“My current assumption is that China is doing this to gain leverage over the US in advance of the President's upcoming meeting with Xi,” Ball said.

The White House did not respond to a request for comment from Just the News about the new export controls.

At a cabinet meeting on Thursday, President Trump said that he had been made aware of the measures, but had not yet been briefed. At that meeting, the president said that the U.S. could retaliate by reducing purchases of Chinese goods.

“We import from China massive amounts,” Trump said. “Maybe we’ll have to stop doing that.”

The new measures include additional rare-earth elements and related materials such as alloys and magnetic components. Many of these components are used in advanced defense or telecommunications applications. The regulations note that if any rare earths are destined for end-use in the most advanced types of semiconductors, the regime will reserve the right to approve the exports on a case-by-case basis. These will take effect on Dec. 1, according to the ministry.

The restrictions also encompass technologies related to rare-earth mining, smelting, separation, and magnet manufacturing. Notably, products manufactured abroad that incorporate Chinese-origin rare-earth materials in quantities exceeding 0.1% by value will be subject to these controls, meaning China is attempting to exploit its dominance to extend its regulatory authority to transactions between third parties abroad.

China protecting dominance in sector

If enforced strictly, these measures could potentially impact global supply chains and hamper other countries trying to replicate China’s dominant rare earths mining sector.

China justified the new restrictions by citing national security concerns and the need to protect sensitive technologies. The government also specifically cited the use of Chinese rare earths for military applications as a cause for concern.

Chinese state media reported that the policies would prevent exports completely for any foreign military application. “Chinese regulators will not approve export applications for foreign military users, as well as export applications for importers and end-users listed on export control or watch lists,” the Global Times reported.

In addition to rare earths, China announced new measures restricting exports of equipment needed to manufacture lithium ion batteries, the central component to the burgeoning electric vehicle industry.

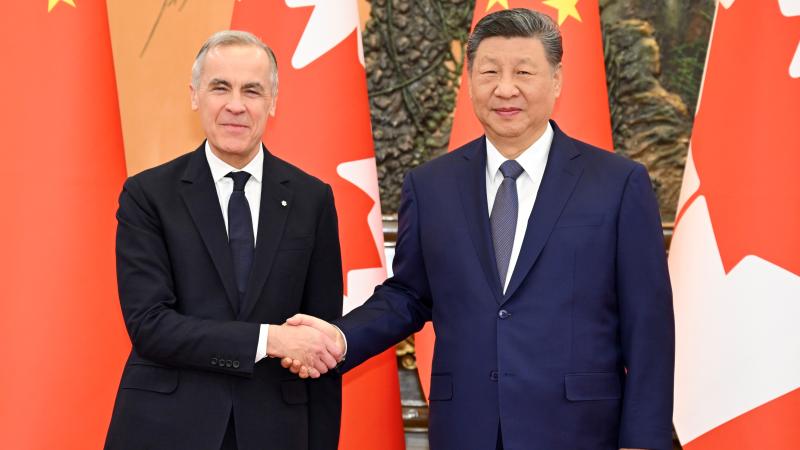

A meeting between Trump and Xi is not yet confirmed, but the American president has repeatedly expressed his desire to sit down face to face with his Chinese counterpart to hammer out ongoing trade disputes.

Last month, Trump announced that he and Xi agreed during a phone call that they would sit down for that meeting in South Korea to discuss bilateral issues. That meeting is set to take place on the sidelines of the Asia-Pacific Economic Cooperation forum in the last week of October in Gyeongju, South Korea.

Rare earth metals, of which China has a near monopoly on mining and refining, have been at the center of trade negotiations between Washington and Beijing. Rare earths are critical for many of the most advanced modern technologies, but the United States’ capacity to extract and refine the metals lags significantly behind its biggest competitor.

In 2023, China accounted for 69% of the world's production of rare earth elements, far ahead of the United States’ 12% share. Rare earths are a family of 17 metals that have similar properties valuable for everything from advanced magnets to semiconductor manufacturing.

The Chinese rare earths restrictions largely come in retaliation for waves of tariffs and U.S. export restrictions on advanced semiconductor manufacturing equipment. After taking office in January, President Trump imposed several tariffs on China for its failure to combat fentanyl precursor chemicals, targeting steel, automobiles, and other goods that once reached over 100%.

After China’s first round of restrictions on rare earths in June, the Trump administration negotiated a temporary 90-day tariff pause that capped the duties at 30% while broader trade negotiations remained ongoing.